Implied Risk. Zero Control.

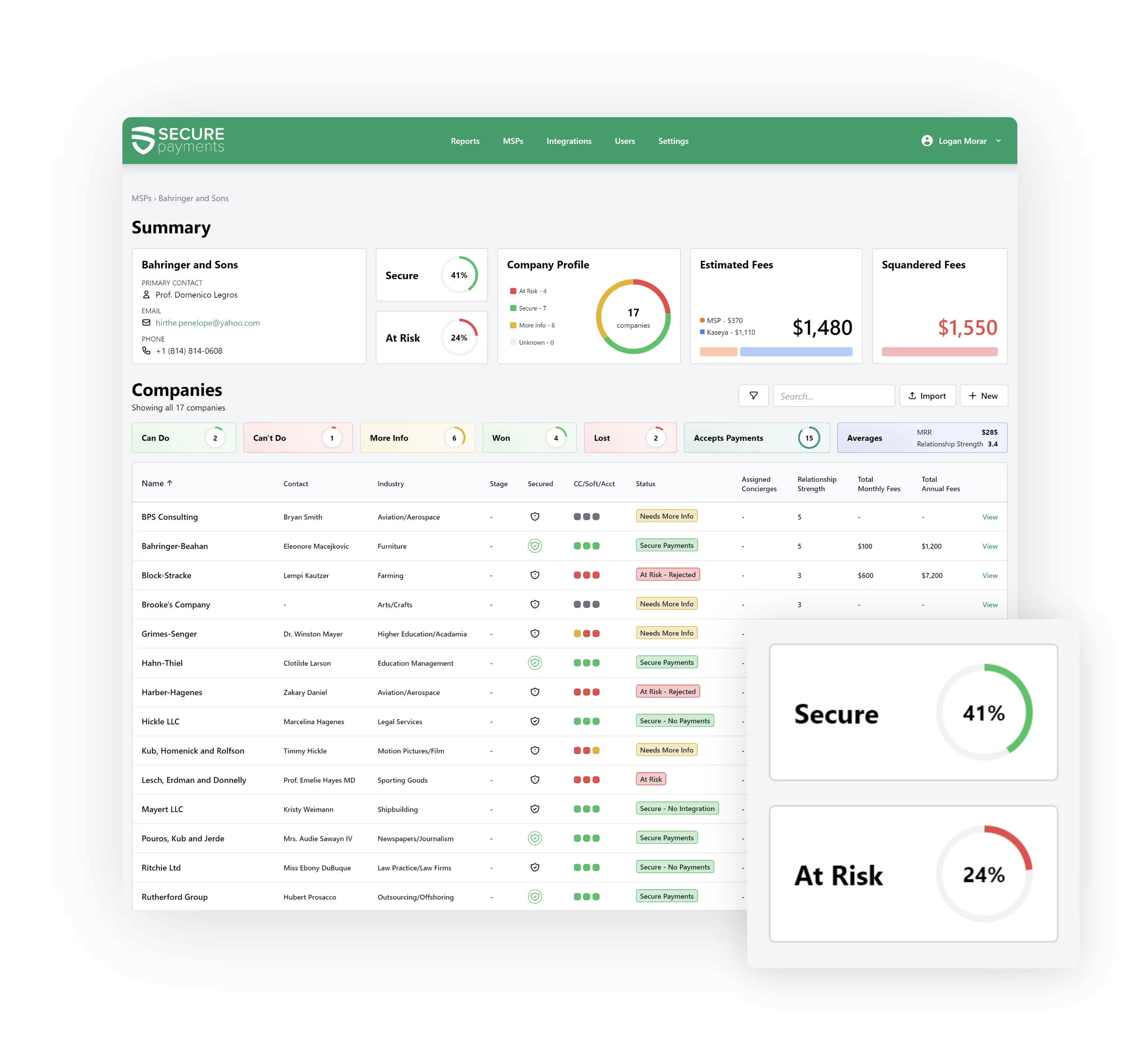

All MSPs provide cybersecurity for their customers and most assume this includes payment security. The problem is MSPs lack the visibility and tools to identify and resolve the risks associated with PCI compliance. The end result is assumed liability to the MSP and lack of awareness to the downstream customer.

You may even already use a system like Compliance Manager by RapidFire Tools. However, as necessary, and as good as these tools are, they won’t help you with this part of PCI compliance. These tools cover the network side: firewall, AV, password manager, documentation, and software updates. Great job!

However, this leaves the merchant side vulnerable—unless, of course, you're already partnered with Secure Payments. Only then can you be confident in offering comprehensive protection.

That’s because not only does Secure Payments cover the hidden piece of the PCI compliance puzzle: there is no other company that does. So, unless you're a Secure Payments customer, you're not fully covering your customers' PCI compliance needs. At least not 100% of it.

Credit card data is the most coveted information for theft—and the most overlooked by MSPs who lack the visibility to protect it.

A single non-compliant customer puts your MSP at risk of fines and penalties and reputation damage.

Fines range from $5k to $100k per incident. This means if the fine is $50k per incident and the stolen credit card is used at the same merchant 6 times, their fine would be $300k.

Your customers think you’re protecting them. If you wait until another MSP identifies this or they’re breached, they will blame you.